salt tax cap news

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. December 12 2021 930 AM 4 min read.

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

A deal later announced between Manchin and Senate Majority Leader Chuck Schumer on a fiscal package that spans tax climate and health care measures also omitted any SALT-cap expansion.

. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on. And while its presently due to sunset in 2025 Suozzi should. New location on.

The climate change deal brewing in Congress which would fund the massive investment in clean energy with new taxes on corporations came. Dave Goldiner New York Daily News 1152021. It would have extended the 10000 cap on the state and local tax deduction set in the 2017 GOP tax law by another year to 2027.

Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed. That cap is unpopular with voters in high-tax states like. At least hes trying.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. By Aysha Bagchi Perry Cooper and Donna Borak. March 1 2022 600 AM 5 min read.

Salt tax cap news. The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms. Americans who rely on the state and local tax SALT deduction.

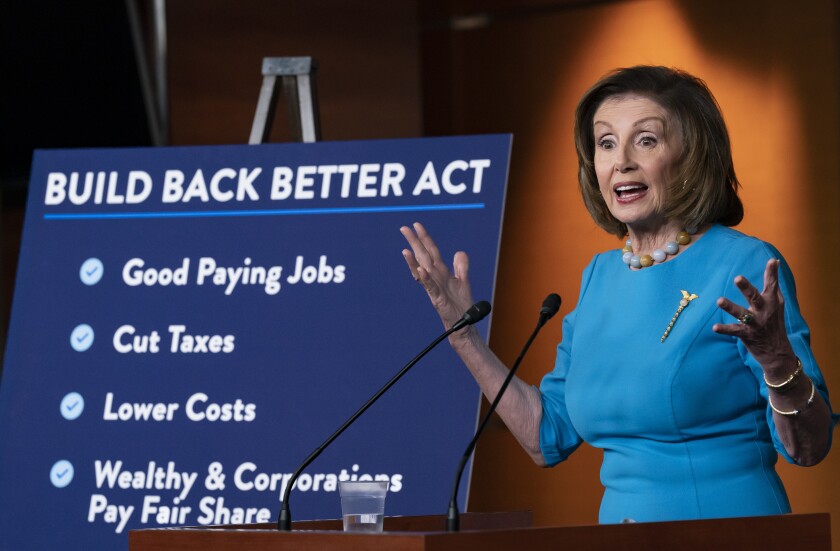

Enacted by the Tax. Friday June 10 2022. House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back.

This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. PISCATAWAY NJ -- Check out TAPinto Piscataway today at National Night Out 2022. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard.

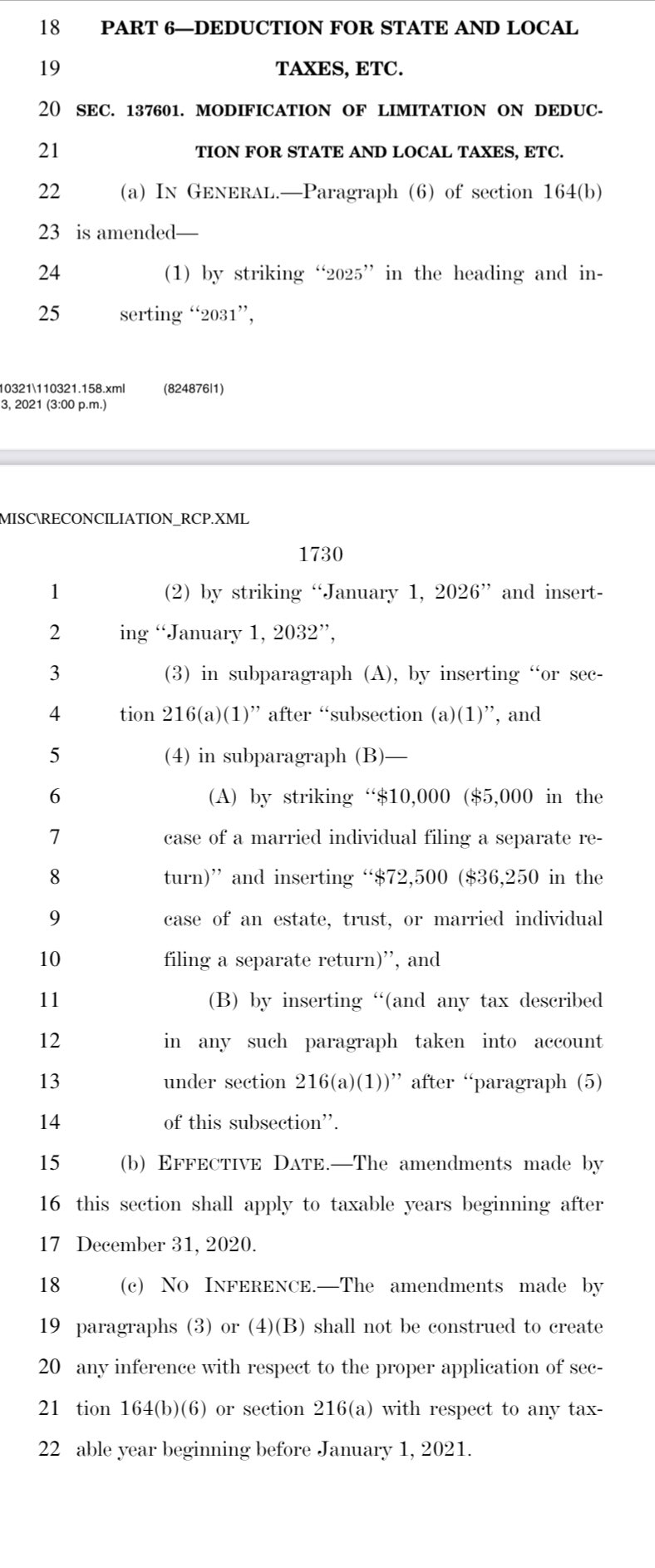

The Biden Administrations Build Back Better Act proposes raising the cap currently set at 10 000 to 80 000. News April 20 2022 at 1012 AM Share Print. Of particular note to counties however unlike the Build Back Better Act the IRA does not include relief from the 10000 cap on the state and local tax SALT deduction enacted in the 2017 Tax Cuts and Jobs Act.

The House-passed bill would have raised the SALT cap to 80000 and would have extended the cap past its 2025 expiration date as a. Not in these quarters. National Night Out 2022 in Piscataway.

One of the biggest changes felt by homeowners in New Jerseythe state with the highest property taxes in the nationwas the state and local tax SALT deductions which include property income and sales taxes. The 2017 Tax Cuts and Jobs Act took effect for taxpayers upon filing their 2018 tax returns earlier this year. 12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT deductions.

The 2017 Tax Cuts Jobs Act passed under former President Donald Trump imposed a 10000 cap on state and local tax deductions known as the SALT deduction. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately. The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000.

But what is the SALT cap. Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US. Local newspaper covering news sports police fire and government issues for Piscataway NJ 08854.

Enacted by the Tax Cuts and Jobs Act of. A new bill seeks to repeal the 10000 cap on state and local tax deductions. The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions.

Americans who rely on the state and local tax SALT deduction at. Taxpayers can deduct up to 10000 of the state and local. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000 and that most middle. The SALT deduction cap would stay at 10000.

Capitol on April 15 2021.

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Most New York Times Matt Dorfman Design Illustration Illustration Design Newspaper Design Health Magazine Layout

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Commercializing Solar Power With Molten Salt Solar Energy Panels Solar Energy Diy Concentrated Solar Power

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Why This Tax Provision Puts Democrats In A Tough Place Time

We Re No 51 Utah Last Again For Per Student Spending Tuition Vocational School Bloomberg Business

Utah Lawmakers Set To Consider Several Cryptocurrency Bills This Session In 2022 Cryptocurrency Investing In Cryptocurrency Blockchain Technology

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Legislation Introduced In U S House To Restore The Salt Deduction